Economic Outlook: Navigating the Shifts in Today's Chemical Distribution Industry

- Oct 16, 2025

- Joseph Donadoni

Chemical products are the building blocks supporting the health and safety of our daily lives – and our economy. The chemical industry, however, has faced high inflation, labor shortages, and significant uncertainty over the past few years.

We are currently experiencing the highest tariff levels since the 1930s, there are rising concerns about U.S. debt sustainability, and we’re facing an unstable geopolitical landscape, all of which are impacting economic stability and future growth. ACD members have access to monthly and quarterly economic reports from our partners at Swift Economics, LLC to help them navigate these challenges. As we head into the fourth quarter of a tumultuous 2025, we wanted to share the latest assessment of the economic outlook from the Swift Economics team.

Overall, the U.S. economy is sending mixed signals with inflation rising and employment slowing. Although the global economy appears to be holding up amid this uncertainty, overall growth is slowing as U.S. and China enter a phase of weaker momentum. U.S. economic growth is expected to ease and then return to long-term growth trends in the second half of 2026.

Many chemical distribution companies interact with manufacturers as both suppliers and customers and results in this sector have been mixed. Overall, U.S. industrial production edged up 0.1% in August, partially offsetting a 0.4% decline in July. Despite production edging up, headline capacity utilization for all industry was stable at 77.4% in August, a rate that is 2.2 percentage points below its long-run (1972–2024) average.

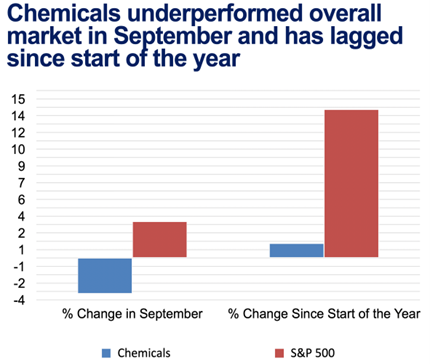

The global chemical industry has experienced several years of downcycle, resulting from overcapacity and structural and competitive challenges. In September, chemicals have underperformed in the overall market, and the sector has lagged since the start of the year. Even though demand for specialties and fine chemicals increased in August, only 13 out of 30 market segments expanded. This includes pharmaceutical ingredients, catalysts, lubricant additives, mining chemicals, oilfield chemicals, and textile specialties, all of which featured strong gains. Coatings, corrosion inhibitors, dyes, electronic chemicals, and industrial & institutional cleaners also moved up. Among basic chemicals and other synthetic materials there was improvement in chlor-alkali, pigments, other inorganic chemicals, bulk petrochemicals, downstream organic intermediates, and plastic resins during August.

The global chemical industry has experienced several years of downcycle, resulting from overcapacity and structural and competitive challenges. In September, chemicals have underperformed in the overall market, and the sector has lagged since the start of the year. Even though demand for specialties and fine chemicals increased in August, only 13 out of 30 market segments expanded. This includes pharmaceutical ingredients, catalysts, lubricant additives, mining chemicals, oilfield chemicals, and textile specialties, all of which featured strong gains. Coatings, corrosion inhibitors, dyes, electronic chemicals, and industrial & institutional cleaners also moved up. Among basic chemicals and other synthetic materials there was improvement in chlor-alkali, pigments, other inorganic chemicals, bulk petrochemicals, downstream organic intermediates, and plastic resins during August.

Although volatility and uncertainty are now considered normal market conditions, businesses must remain agile to prepare for potential shocks and to ensure businesses remains resilient. Scenario-based strategies will be critical in the months to come.

The chemical distribution industry plays a profound role in everyday life and ACD recognizes the importance of efficient, safe, and reliable operations to advancing innovation, creating more jobs, and ensuring the continuity of the entire global supply chain.

This information, and more, can be found in Chemical Market Pulse, an economic report published monthly and quarterly. ACD members can access the monthly report for free. while both the monthly and quarterly reports are available for purchase on ACD U.